Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Wednesday, May 30, 2007

Harry Potter Mania

This was posted on Mugglecast:

Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Universal Studios and Warner Brothers made a joint announcement this evening from Leavesden Studios on the set of Dumbledore's Office to reveal that a Harry Potter theme park is currently in development. The image to the (right) is the first piece of concept art for the park: Hogsmeade Village.

Here's what we learned from Potter set designer Stuart Craig and a representative from Universal Studios (both of whom hosted the big reveal):

- "The Wizarding World of Harry Potter at Universal Orlando Resort"

- Announcement was made live via internet at 12:01 AM EST today to select media, including MuggleNet.

- Areas of park to include Hogsmeade, Hogwarts Castle, and the Forbidden Forest.

- 20 engineers working on project.

- Universal came to WB looking for authenticity.

- Potter park to be built in "Islands of Adventure" area of Universal.

- Stuart wants to "take his grandchildren" to the park.

- Opening early 2010.

- Universal's Potter website to be available at this link soon.

- JK Rowling has been involved "since the very beginning" of the project. Also "supportive and encouraging."

- Stuart thinks that the park will be better off in the United States.

- Have been in design "for at least a year and a half."

- "Important that the theme park represents the entire saga from Book 1 to Book 7"

In a rather cute way to end the announcement, the Universal representative asks Stuart Craig, "Now where's Dumbledore?" Stuart paused for a moment, looked around the office, and replied, "He was just here."

The fansites will be receiving a special piece of concept art not seen anywhere else, so stay tuned for that! We'll be discussing these developments on this week's episode of MuggleCast (due out over the weekend). This post will be updated frequently as we learn more!

Also, check out this clip of ORDER OF THE PHOENIX that was on ELLEN. It's Umbridge to perfection!

Tuesday, May 22, 2007

The First of the Cannon Grandkiddies

I finally took a picture of Mitzi's ultrasound and "our little bean," so here it is: We were worried for a little while that Mitzi may have miscarried which is why we went in for the ultrasound early, thus getting a picture of our baby when it still looks nothing like a baby. From what I can tell, the dark bean shaped area is either fluid or the area that was being compressed by the ultrasound machine, but the baby itself is that little fuzzy bean at the bottom of the dark area. We are so excited and just wanted everyone to share our first glimpse of the newest little baby Cannon! Hooray for Mom and Dad, who will soon become Grammy and Grumps!

We were worried for a little while that Mitzi may have miscarried which is why we went in for the ultrasound early, thus getting a picture of our baby when it still looks nothing like a baby. From what I can tell, the dark bean shaped area is either fluid or the area that was being compressed by the ultrasound machine, but the baby itself is that little fuzzy bean at the bottom of the dark area. We are so excited and just wanted everyone to share our first glimpse of the newest little baby Cannon! Hooray for Mom and Dad, who will soon become Grammy and Grumps!

We were worried for a little while that Mitzi may have miscarried which is why we went in for the ultrasound early, thus getting a picture of our baby when it still looks nothing like a baby. From what I can tell, the dark bean shaped area is either fluid or the area that was being compressed by the ultrasound machine, but the baby itself is that little fuzzy bean at the bottom of the dark area. We are so excited and just wanted everyone to share our first glimpse of the newest little baby Cannon! Hooray for Mom and Dad, who will soon become Grammy and Grumps!

We were worried for a little while that Mitzi may have miscarried which is why we went in for the ultrasound early, thus getting a picture of our baby when it still looks nothing like a baby. From what I can tell, the dark bean shaped area is either fluid or the area that was being compressed by the ultrasound machine, but the baby itself is that little fuzzy bean at the bottom of the dark area. We are so excited and just wanted everyone to share our first glimpse of the newest little baby Cannon! Hooray for Mom and Dad, who will soon become Grammy and Grumps!

Monday, May 21, 2007

Financial Niftiness

Hey everybody, I just wanted to share with you some of the nifty things I've been learning while substitute teaching at Mitzi' s school (the kids are watching October Sky, which I will have seen 8 times by tomorrow). I'm wondering if I could even start a weekly financial tip on the blog, but maybe I should start my own so as to not cramp the style of the Cannon Family Blog. I've also been meaning to post the picture of Mitzi's ultrasound on the blog but because the internet connection at our house only works when I take my computer out into the back yard, I haven't been able to post it yet. I will try to get it up soon so you can all see "our little bean." So here's what I've been learning. I spoke a bit about Expense Ratios during our financial home evening, but I don't know if I really made it clear what a difference they make over time. I've been looking at the retirement account that Mitzi's school has set up for their teachers, and I've been unable to locate any specific expense ratios for any of the investment options. However, I did find one that disclosed an expense ratio of 3.21%. For those of you who don't know what that means, 3.21% is ASTRONOMICAL! I will illustrate this point shortly. As I continued searching, I found other expense ratios that ranged between 1.35% and 1.75%. Remember, almost every index mutual fund at Vanguard has an expense ratio below 0.25%! Now, let's see how this whole thing pans out (the following is taken from my Financial Literacy glossary that I have been working on and is nearing completion):

Let's say an investment broker sells a school on the idea of putting their employees’ retirement funds in a “tax-sheltered” annuity. The school buys the pitch and the broker may or may not mention something about an annual expense ratio anywhere between 3.21% and 1.35% on these annuity holdings. Let’s say Jane puts her money in the school’s plan and contributes about $5,000 over her two years teaching before she has kids and stops working, leaving her money there to grow and compound in this wonderful tax-sheltered account her school provided her with. Now let’s say Joan also contributes $5,000 over her two years teaching and when she stops working she rolls over her $5,000 into an IRA at Vanguard and invests in one of their Target Retirement funds with an expense ratio of about 0.21%. Both women leave their $5,000 for 40 years an then excitedly contact their investment firms to find out how much their $5,000 investments have grown to over the 40 years. Let’s assume the market returns an average of 10% annually over those 40 years. The results would be thus:

Jane's return after 40 years if she unluckily picks the highest expense ratio: $65,331

Jane's return after 40 years if she luckily picks the lowest expense ratio: $142,577

Joan's return after 40 years by moving her assets to Vanguard: $228,369

Now remember, these figures are all based on the SAME EXACT PERFORMANCE over the 40 year period--look at what a difference expenses make! Also consider that taxes will be taking a chunk out of their distributions once they start withdrawing them during retirement, and Jane's not going to have much to spare. Lastly, these figures aren't even adjusted for inflation. After inflation, let's take a look:

Jane's high ER return (after inflation): abt. $20,000

Jane's low ER return (after inflation): abt. $43,000

Joan's Vanguard return (after inflation): abt. $68,000

It's just sickening to me to think that 90% of the employees at Mitzi's school (the inspiration for the above example) probably have no idea how mercilessly and remorselessly they are getting scammed by these bad investments. Even more upsetting is that by the time they find out what has happened, it will be far to late to make any difference.

THE MORAL: If any of you have investments or retirement plans through employers, look for or request information about your investment's Expense Ratios, and then move your investments around to get into the funds that have the lowest expenses of the bunch - over the long run they will almost invariably be the winners (for you) simply because regardless of what they make, more of it will be going to you and less to the money managers.

On another note, I've been figuring out what kind of portfolio I want to make with the inheritance money from mom. I finally worked out all of the mix-ups with Edison and sold my shares after they had risen over $4,000 in four months, but now I have just under $30,000 to develop a nice index portfolio of my own. Most of the Vanguard index funds require a $3,000 minimum investment, but the IFA index portfolio I really want to get into requires a $100,000 minimum investment. So I examined their asset allocation and decided that I could quite closely replicate the asset allocation of the IFA Red 100 portfolio if I spread that $30,000 out across various Vanguard indices. Now if I am successful and managed to capture the 35 year return of 15.28% on the IFA Red 100, after 40 years that $30,000 will be worth...drum roll please...$8,907,170.32!!!

Now mind you, that's not adjusted for inflation (although it is adjusted for an average 0.25% Expense Ratio), and it assumes that I will have managed to move that $30,000 into my tax-sheltered IRA at Vanguard (taking Uncle Sam out of the front-end of the equation), which will actually take me another 5+ years to do. Now when you don't adjust for inflation, the numbers are much more impressive, but no one eats before inflation dollars, so I don't want to mislead anyone into thinking this silent devourer is escapable. So after 40 years of inflation, the same amount will actually be worth...$2,966,842.94!!! That would allow us to live on $216,000 per year in retirement just from the interest (and a lot more than that if we took distributions from the principle as well). Unfortunately, things are a tad more complicated (such as market fluctuations that will impact your interest returns from year to year, earning you $216,000 one year, $300,000 the next, and $100,000 the next, and so forth), but the core concept is sound.

That's not bad! Now if the market doesn't do quite so well (or I don't do so well at replicating their portfolio), then here are a couple of other contingencies:

14% annual return (adjusted for inflation): $1,853,730

12% annual return (adjusted for inflation): $879,313

10% annual return (stock market average - adjusted for inflation): $411,376

8% annual return (adjusted for inflation): $189,717

5% annual return (bond market average - adjusted for inflation): $57,770

Who knows what will actually happen, but what I do know is that I will be paying the lowest expenses possible and so whatever the market returns, 97% will be going to me, as opposed to the 85% to 65% left to investors who don't know their expense ratios.

Well, I hope you all feel more financially literate having read this. I will be finishing up my financial glossary soon and will be making a copy available to anyone who is interested. There are some very simple things you can do to safeguard your investments, because if you don't, you could be swindled so viciously that even Jane could outperform you.

Sunday, May 13, 2007

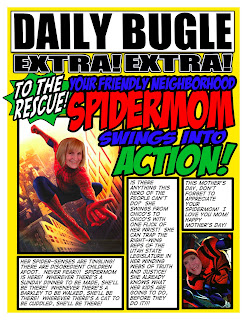

Happy Mother's Day

to my wonderful Mother!

I wanted to send you a big HUG and KISS and tell you how much

I LOVE YOU!

I'm so lucky to be your daughter and I'm thankful to have gotten the

bestest mother I could have ever asked for!

Love you lots!

xoxox ~ Carole

P.S. Don't you love this picture? It makes me laugh:)

Happy Mother's Day

to my wonderful Mother!

I wanted to send you a big HUG and KISS and tell you how much

I LOVE YOU!

I'm so lucky to be your daughter and I'm thankful to have gotten the

bestest mother I could have ever asked for!

Love you lots!

xoxox ~ Carole

P.S. Don't you love this picture? It makes me laugh:)

Saturday, May 12, 2007

Thursday, May 3, 2007

Happy Birthday Scootie!

I'm so spoiled!

Look at what I got! Isn't it pretty? Aaron caved last weekend and bought me a brand spankin' new SURFBOARD! Not because I wanted one really - well maybe secretly... but mostly because he wants me to learn how to surf with him so he doesn't get in "trouble" for wanting to go every night after work. hehe. So I guess I'll have to start now. And it probably won't be such a bad thing - once I get better and I'm not so frustrated:) So right after we bought it, Aaron could hardly contain his excitement, and of course we headed straight to the waves! It look me what seemed like forever to get out past where I wasn't getting pummeled every 10 seconds by massive amounts of water. Once I did though, I still had a smidgen of arm strength left and managed to paddle hard enough to catch my first real wave! I rode it out on my stomach the whole way! I was so excited and going so fast that I forgot to stand up! It sure was fun though:)

So Aaron surfed in and told me I did such a great job! And all I need to do next time is stand up - duh. So we turned around and I held onto his ankles while, with his HE-MAN strength, paddled both of us out past the crashing waves. I tried, tried again, only to fail miserably. But we had so much fun! It was a beautiful evening, dark and cloudy and the water was eerily calm. The waves were rolly and smooth. There were tons of pelicans and fish jumping everywhere. It was a cool experience, and very humbling. I look forward to getting better and I'm sure it will end up being another board sport that I love. It looks like a lot of fun, and hopefully would get me into better shape! That's always and incentive.

So Aaron surfed in and told me I did such a great job! And all I need to do next time is stand up - duh. So we turned around and I held onto his ankles while, with his HE-MAN strength, paddled both of us out past the crashing waves. I tried, tried again, only to fail miserably. But we had so much fun! It was a beautiful evening, dark and cloudy and the water was eerily calm. The waves were rolly and smooth. There were tons of pelicans and fish jumping everywhere. It was a cool experience, and very humbling. I look forward to getting better and I'm sure it will end up being another board sport that I love. It looks like a lot of fun, and hopefully would get me into better shape! That's always and incentive.

So Aaron surfed in and told me I did such a great job! And all I need to do next time is stand up - duh. So we turned around and I held onto his ankles while, with his HE-MAN strength, paddled both of us out past the crashing waves. I tried, tried again, only to fail miserably. But we had so much fun! It was a beautiful evening, dark and cloudy and the water was eerily calm. The waves were rolly and smooth. There were tons of pelicans and fish jumping everywhere. It was a cool experience, and very humbling. I look forward to getting better and I'm sure it will end up being another board sport that I love. It looks like a lot of fun, and hopefully would get me into better shape! That's always and incentive.

So Aaron surfed in and told me I did such a great job! And all I need to do next time is stand up - duh. So we turned around and I held onto his ankles while, with his HE-MAN strength, paddled both of us out past the crashing waves. I tried, tried again, only to fail miserably. But we had so much fun! It was a beautiful evening, dark and cloudy and the water was eerily calm. The waves were rolly and smooth. There were tons of pelicans and fish jumping everywhere. It was a cool experience, and very humbling. I look forward to getting better and I'm sure it will end up being another board sport that I love. It looks like a lot of fun, and hopefully would get me into better shape! That's always and incentive.

Wednesday, May 2, 2007

Hey Everyone-

Here are some pictures from Clark's crazy birthday extravaganza this year. We played Dodgeball and were all terribly sore the next day and managed to cream each other rill good. HA!!! We had delicious mounds of strawberries and whipping cream and we tired Barkley right out! HAPPY BIRTHDAY CLARK!

Hey Everyone-

Here are some pictures from Clark's crazy birthday extravaganza this year. We played Dodgeball and were all terribly sore the next day and managed to cream each other rill good. HA!!! We had delicious mounds of strawberries and whipping cream and we tired Barkley right out! HAPPY BIRTHDAY CLARK!

Tuesday, May 1, 2007

The OFFICE

This is what we've all been waiting for! This is the website/blog that posts what Micheal Scott would cost Dunder Mifflen in legal fees.

www.hrheroblogs.com/

Barkley Blog!

I found this cute little website during the 8 hours I get to spend browsing the internet while I work. I thought it was cute. So many cute puppy pictures and beautiful Bernese Mountain dogs! We could start our own little Barkle Bee Blog! Make sure to watch some of the videos. They're the cutest! Looks like Mandy has some new tricks to get Barkley working on.

http://www.dogster.com/dogs/21229

http://www.dogster.com/dogs/38961

I found this cute little website during the 8 hours I get to spend browsing the internet while I work. I thought it was cute. So many cute puppy pictures and beautiful Bernese Mountain dogs! We could start our own little Barkle Bee Blog! Make sure to watch some of the videos. They're the cutest! Looks like Mandy has some new tricks to get Barkley working on.

http://www.dogster.com/dogs/21229

http://www.dogster.com/dogs/38961

Subscribe to:

Posts (Atom)